The Reserve Bank of Australia’s (RBA) recent decision to hold the cash rate at 4.35 per cent will have significant implications for investors.

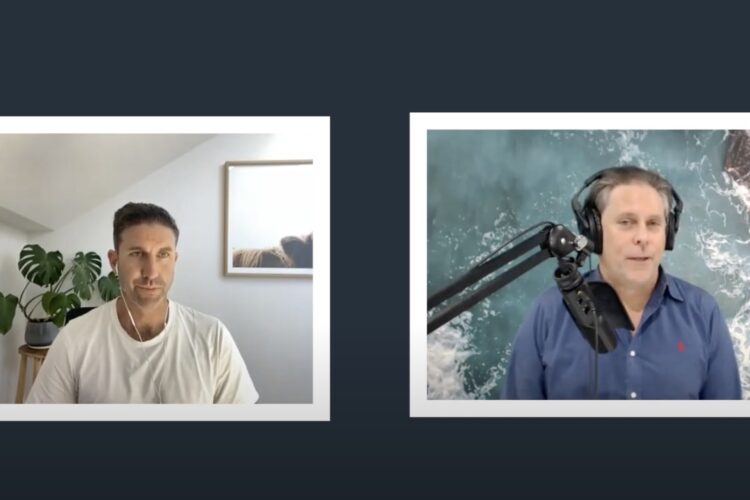

In this episode of The Smart Property Investment Show, host Phil Tarrant chats with Finni Mortgages CEO Paul Glossop about why the RBA’s latest interest rate decision comes at a turning point in the nation’s financial landscape.

The duo discuss how lowering inflation and stabilising cash rates could lead to a “trust jail” for investors whose banks refuse to reprice in line with rate reductions.

The episode also reveals the far-reaching consequences of the current government policy, which may disincentivise investment in the long term.