How mortgage holders can deal with the latest rate hike. With the Reserve Bank (RBA) announcing its policy decision for June, borrowers are bracing for another rocky month marked with more mortgage pain.

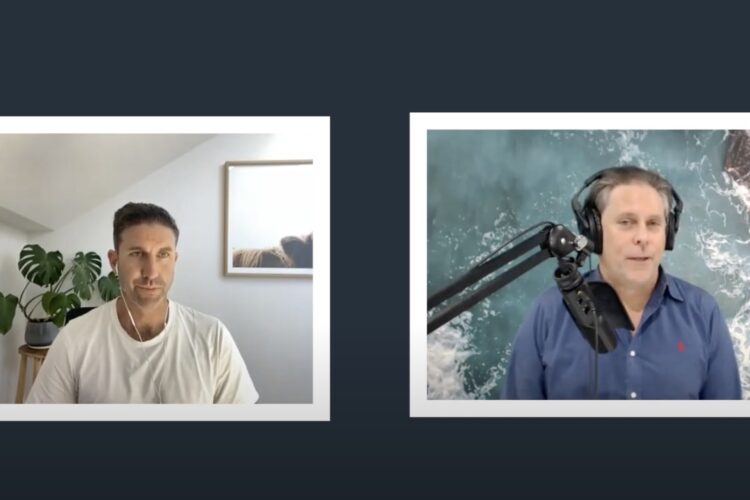

In this episode, Smart Property Investment’s Phil Tarrant and Finni Mortgages’ chief executive, Paul Glossop, talk about the central bank’s move to take another swipe at inflation, how mortgage holders are being caught in the crossfire and why they think borrowers are not completely “out of thewoods” just yet.

While the duo acknowledge it will take a longer time for the rate rise cycle to reach its last stop, they explore the different ways borrowers can find reprieve amid the rising mortgage squeeze — including a modified serviceability assessment rate offered to those who have a good track record among lenders.

Lastly, they advise property owners to focus on “longevity”, explain why one’s borrowing capacity is “just one aspect” of the equation, and discuss the importance of “stress testing” your personal cash flow.