Dwelling prices will fall eight per cent this year and be 15 per cent down peak-to-trough, according to the major bank.According to the Commonwealth Bank of Australia’s (CBA) State & Territory Quarterly Perspective, the housing market will continue to see house price declines over this year and next.

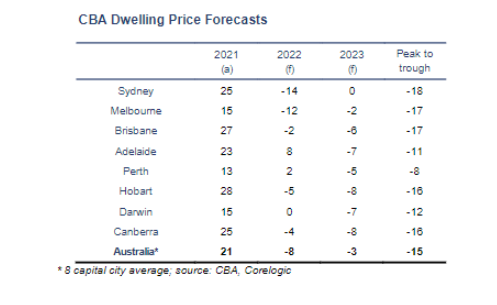

CBA’s Dwelling Price Forecasts show that the major bank expects dwelling prices to drop eight per cent across Australia this year, and by another 3 per cent in 2023.

The forecasts, which pull from both CBA and CoreLogic data, reveal that Sydney and Melbourne are expected to be the worst off of all capital cities this year (falling 14 per cent and 12 per cent, respectively), with Canberra, Adelaide and Darwin expected to drop the most substantially in 2023. According to the forecasts, Canberra will see prices drop by 8 per cent next year, with Adelaide and Darwin both seeing prices fall by 7 per cent, according to the bank.

When looking peak-to-trough, Sydney would be the worst off of all capitals, the data shows, down 18 per cent. This would be followed by Melbourne and Brisbane – both expected to be down 17 per cent peak-to-trough.

Of all capitals, Perth is estimated to be the capital that would be most protected, with values only falling 8 per cent over the peak to trough period, according to CBA.

The bank also noted that most of the country “has now turned”, with all state capitals experiencing a decline during the month of August.

Data collected by CoreLogic indicated that Sydney saw the largest decline out of all the capitals at a 2.3 per cent fall in August, followed by Brisbane that saw a decline of 1.8 per cent, Melbourne at 1.2 per cent and Hobart at 1.7 per cent.

Although still recording a fall in dwelling prices, Adelaide and Perth held up better than the other capitals, only registering 0.1 per cent and 0.2 per cent falls, respectively.

However, CBA’s quarterly perspective further outlines that dwelling prices still remain higher since the onset of the COVID-19 pandemic. According to the data, Adelaide is a “clear standout” at 44.0 per cent above the April 2020 level.

On the other hand, Melbourne dwelling prices are only 5.9 per cent higher when compared to the same period.

The report stated that the divergence in capital city trends along with the strength of regional dwelling prices is attributed to the impacts of the pandemic, relative housing affordability and changes in net interstate migration patterns.

CoreLogic’s latest Pain & Gain Report analysed approximately 102,000 property resales that occurred in the June 2022 quarter with data revealing that profit-making sales plateaued at 93.8 per cent compared to the previous three months.

The figures were down from three months to April when the portion of property owners gaining profits from resales was at 94.1 per cent, which coincided with national dwelling values hitting their highest level during the year.

The June quarter saw median nominal gain made on resales nationally sit at $270,000, while median losses were -$33,500.