Hundreds of thousands of borrowers with fixed-rate mortgages face a bumpy road ahead this year as record-low fixed-rate loans expire and higher “revert” rates hit.

Banks are calling it a “fixed-rate cliff”, and the worst thing you can do is wait for it to happen.

There’s no need to panic; interest rates are simply returning to normal levels. However, if your fixed-rate loan is due to expire this year, your interest rate could potentially double.

One thing is for sure: your best move is to look at your options now and tackle the so-called fixed-rate cliff head-on.

Whether you break your loan term and refinance early or schedule loan settlement for when your current loan matures, there’s an opportunity right now to snag a better deal if you’re willing to invest a bit of time and effort.

The fixed-rate cliff

An estimated $29.8 billion worth of fixed-rate mortgages expired in 2022, and by the end of 2023, that number is forecast to total $158 billion.

The Commonwealth Bank (CBA) and Westpac alone have a total of $99 billion worth of mortgages coming off fixed rates in the second half of 2023.

Fixed-rate borrowers who secured loans at record-low pandemic rates need to get a handle on current interest rates to get a sense of what to expect.

RateCity predicts borrowers could be looking at revert rates of over 7 per cent if the Reserve Bank of Australia (RBA) cash rate increases another 1.25 percentage points to 3.85 per cent. Two of our biggest banks, Westpac and ANZ, expect this to happen.

The fixed-rate cliff affects a pool of around 500,000 borrowers, according to Canstar. They’ll feel the impact of all the rate hikes since May 2022, all in one go.

There have been nine cash rate increases and there are more coming. The RBA lifted the cash rate to a 10-year high of 3.35 per cent in February 2023, and RBA governor Philip Lowe confirmed that there are more increases to come, but said the RBA “is not on a preset course”.

CBA predicts we could see rate cuts start in November 2023; however, Westpac and ANZ don’t expect cuts until November 2024, and NAB doesn’t anticipate any cuts in the next two years, according to RateCity.

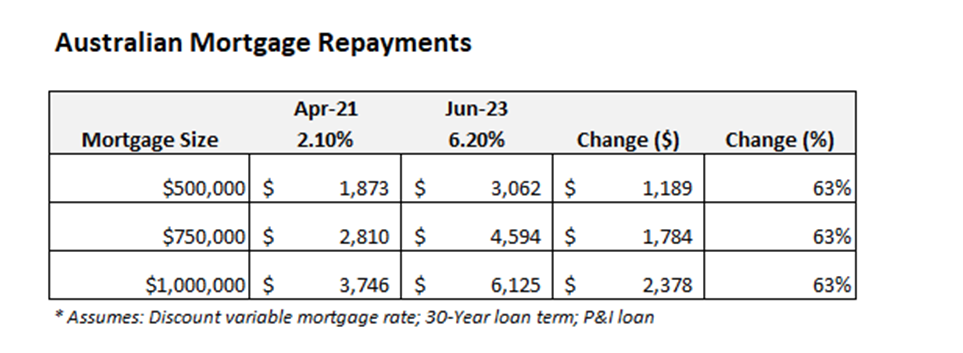

The average two-year fixed rate in 2020 was 2.46 per cent, and borrowers who roll off their fixed loan this month can expect an average variable rate of 5.43 per cent. That’s an increase of 2.9 per cent. On a $600,000 fixed-rate loan at 2.46 per cent, your current monthly repayments would be $2,680 (principal and interest). At 5.43 per cent, they’ll rise to $3,659 a month — that’s a $1,979 increase and is 37 per cent more*.

And that’s a massive jump overnight for the average household.

The honeymoon is about to end, and it’s all a bit of a shock, particularly for those who’ve never had to deal with interest rate rises. If you’ve had a mortgage for less than six years, that could be you.

But it’s not all doom and gloom for fixed-rate borrowers.

The silver lining

While borrowers with variable loans experienced the rate hikes bit by bit, fixed-loan borrowers have been protected. They’ve enjoyed record-low rates and some borrowers have really smashed down their loans. Congratulations if that’s you.

Some borrowers fixed their loans for five or more years at super-low rates. Lucky you if you still have a few years left on your fixed term — enjoy the hiatus.

Borrowers who’ve managed to save or who’ve been making extra payments off their loans are well down. You’ll fare better when your loan expires, but don’t be complacent.

The bottom line is, inflation and rising living costs affect us all and we’re all in this tricky economic time together.

The good news for borrowers is, while interest rates are rising, property prices and lending rates are falling, which means banks are in fierce competition for new business.

Fixed-rate mortgages hit a peak of 46 per cent of all new home loans in July and August of 2021, and banks are now trying to hold onto these customers and win more.

Now is an ideal time for borrowers with reverting fixed-rate loans to shop around for a better deal, rather than wait it out.

If you are on the precipice of the fixed-rate cliff, it’s a good time to rip off the band-aid, get professional advice and work out your game plan.

The pinch

The banks are worried, and for good reason. They’re nervous about their exposure when half a million borrowers’ repayments skyrocket, and they’re worried about the borrowers who’ll be hardest hit.

The RBA famously said it wouldn’t lift the cash rate until 2024, and borrowers made big life decisions with this in mind, like how much debt to take on, starting a family or business, or changing jobs.

Those who don’t have a lot of savings and live paycheck to paycheck are going to feel the pinch when their repayments jump.

Borrowers on one income, such as young families or those who get made redundant or who switch jobs with a pay reduction, will feel the pressure.

Small businesses or the self-employed, who are already dealing with rising business costs, could also feel it.

And it’s not just home owners who need to be on the alert.

Investors, particularly those who bought at the peak, need to keep an eye on their cash flow. They may have money now to cover things like repairs, insurance and strata bills, but they might have to dip into other cash reserves when they get hit with higher interest rates.

One thing is clear: refinancing is the best move for many borrowers on the cliff. The sooner fixed-rate borrowers look into their options and start to tighten the purse strings, the better off they’ll be.

The most vulnerable

Unfortunately, there’s a segment of borrowers who won’t be able to shop around for the best rate and will get stuck with their current banks.

Rising rates and falling property prices mean stricter bank stress tests, and some borrowers won’t have enough equity in their homes to refinance their existing loans. They’re effectively “trapped” when their rates revert.

If you’re one of the so-called “mortgage prisoners”, you need to a) find out as soon as possible and b) talk to professionals until you find a good solution.

Start with your lender or broker, and then talk to a financial counsellor if you need to.

Refinance

Thousands of borrowers on the fixed-rate cliff are already on the front foot and are refinancing in droves.

Refinance activity set a new record in August 2022, according to the Australian Bureau of Statistics (ABS), when almost $13 billion worth of owner-occupier mortgages were refinanced. That’s 17.5 per cent higher compared to August 2021.

Should you refinance? Start your research and find out.

Prepare now

When your fixed-rate loan expires this year, it’ll automatically revert to a variable loan with your current lender and your repayments will increase. This we know. So don’t wait and see, start a conversation with your bank or broker.

Talk to your mortgage broker

Ask your lender for their best rate. Banks have special retention pricing to help keep customers, so it’s a good idea to ask.

Also, find out what your loan-to-value ratio (LVR) is and if you can get a discount based on that. Hopefully, your equity has increased and you can get a better deal.

Don’t fear the break costs

Don’t let the thought of break costs stop you from refinancing early; there may not even be any break costs if you stay with the same lender when you move onto a higher rate.

And even if you switch lenders, the break costs for an early exit could well be lower than what you’ll pay in interest if you don’t exit your loan early.

Shop around

Find out what rates you can get elsewhere. Lenders are welcoming refinancers and will sharpen their pencils for borrowers switching banks. Also, look out for any cashback on offer as an incentive to switch your lender.

Be prepared to move with your feet if your lender won’t match a competitor’s rate. It does take effort to change lenders; however, banks have streamlined the process, and it’s likely worth your while to switch for a better rate.

Also, look at flexibility and think about how you might want to structure your loan.

Do you plan to make extra repayments? A split loan could be a good option — part fixed and part variable offers the best of both worlds. If you want the security of locking in your interest rate so you know how much your monthly repayments will be, then a fixed loan could be your best bet.

Look at your finances

Review your finances and get a really good picture of your financial situation. What are your incomings and outgoings?

Get a good handle on your budget and work out how much of a buffer you have — higher repayments need to come from somewhere.

Think ahead

Do you plan to have a family or sell anytime soon? Want to do renovations? Factor your plans for the future into your financial decisions now and make sure your loan offers the flexibility you’ll need when life changes.

Tighten the belt

I’m not going to talk about smashed “avo on toast”, but we have enjoyed several years of property prosperity. A few adjustments to your spending habits can help free up extra cash for your mortgage and every dollar counts.

Try an online spending tracker or app and you’ll start to see where your money goes and any “lifestyle creep” you may want to rein in.

Make extra repayments

Get into the habit of making additional loan payments now, or put the cash into a separate account that you don’t touch.

Rather than fearing the day your fixed-rate ends, adjust your budget now, while rates are still low, and see how much extra you can funnel into your mortgage.

You’ll soon build up a buffer for emergencies, and you’ll see how ready you are for higher interest rates. If you realise you’re not ready at all, you still have time to take action.

Don’t leave it too late

The best rates we’re going to see for a while are up for grabs right now and loan applications take time.

Give yourself time to get the best deal you can, even if it means scheduling your new loan settlement in the future. Your lender may allow you a “rate lock” for up to three months.

Yes, your bank will contact you about your loan expiration, but only with about six weeks’ notice. You’re better off contacting them now.

Stay focused

There’s a lot of noise out there from experts and no small amount of fear-mongering. The fixed-rate cliff is inevitable, yes, but you don’t have to fall off. Make an informed decision about your best course of action, put it in place and stay your course.

You can’t change inflation or control the Reserve Bank’s cash rate decisions, but you can focus on your own finances and get certainty for your financial future.

Now is the time to shift your money mindset, be proactive and take financial control.

Aaron Christie-David is the managing director of Atelier Wealth